Here are three predictions to expect from the FOMC meeting today. First ask yourself: are they pumping

.cwp-coin-chart svg path {

stroke-width: 0.65 !important;

}

.cwp-coin-widget-container .cwp-graph-container.positive svg path:nth-of-type(2) {

stroke: #008868 !important;

}

.cwp-coin-widget-container .cwp-coin-trend.positive {

color: #008868 !important;

background-color: transparent !important;

}

.cwp-coin-widget-container .cwp-coin-popup-holder .cwp-coin-trend.positive {

border: 1px solid #008868;

border-radius: 3px;

}

.cwp-coin-widget-container .cwp-coin-trend.positive::before {

border-bottom: 4px solid #008868 !important;

}

.cwp-coin-widget-container .cwp-coin-price-holder .cwp-coin-trend-holder .cwp-trend {

background-color: transparent !important;

}

.cwp-coin-widget-container .cwp-graph-container.negative svg path:nth-of-type(2) {

stroke: #A90C0C !important;

}

.cwp-coin-widget-container .cwp-coin-popup-holder .cwp-coin-trend.negative {

border: 1px solid #A90C0C;

border-radius: 3px;

}

.cwp-coin-widget-container .cwp-coin-trend.negative {

color: #A90C0C !important;

background-color: transparent !important;

}

.cwp-coin-widget-container .cwp-coin-trend.negative::before {

border-top: 4px solid #A90C0C !important;

}

1.49%

Bitcoin

BTC

Price

$90,864.03

1.49% /24h

Volume in 24h

$44.44B

<!–

?

–>

Price 7d

// Make SVG responsive

jQuery(document).ready(function($) {

var svg = $(‘.cwp-graph-container svg’).last();

if (svg.length) {

var originalWidth = svg.attr(‘width’) || ‘160’;

var originalHeight = svg.attr(‘height’) || ’40’;

if (!svg.attr(‘viewBox’)) {

svg.attr(‘viewBox’, ‘0 0 ‘ + originalWidth + ‘ ‘ + originalHeight);

}

svg.removeAttr(‘width’).removeAttr(‘height’);

svg.css({‘width’: ‘100%’, ‘height’: ‘100%’});

svg.attr(‘preserveAspectRatio’, ‘xMidYMid meet’);

}

});

today so they can dump it tomorrow after the FOMC meeting?

Almost all economists are expecting a 25 basis point cut, yet nobody’s confident it will feel bullish. Futures pricing via CME’s FedWatch tool shows roughly 85-90% odds of a quarter-point cut, the third of the year, with the fed funds range likely dropping again from the current 4.75–5.00% band.

The catch is the tone. This is shaping up as a classic “hawkish cut” moment:

Inflation is cooling, but not enough for Jerome Powell to declare victory. Core PCE is still running above the Fed’s 2% target on a 12-month basis.

So the Fed can justify easing, but it will not want markets to party like 2021 again. Here are three predictions you need to know:

DISCOVER: 20+ Next Crypto to Explode in 2025

FOMC Meeting Today Prediction #1: What The Dot Plot Could Do To Stocks, Bonds And Crypto

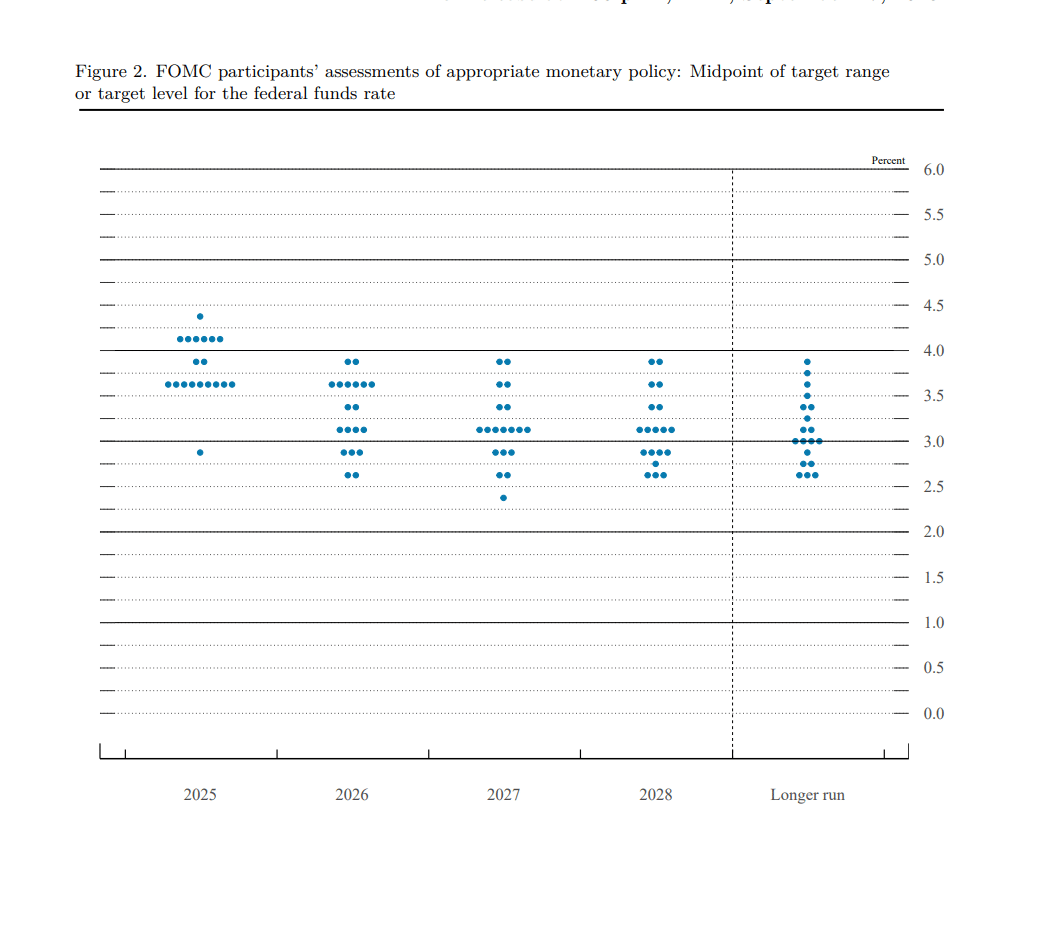

The real drama lands in the Summary of Economic Projections. Let us explain; In September, the median dots pointed to three cuts in 2025 and only one in 2026. If the dots shift toward fewer cuts, or signal a higher-for-longer terminal rate, that hits everything including:

- Long-duration equities first (big tech, speculative growth)

- The belly of the Treasury curve

- High-beta risk like small caps and crypto

Crypto, especially Bitcoin, has been trading like a leveraged bet on real liquidity. When real yields fall, BTC tends to catch a bid; when the Fed leans hawkish, those flows can evaporate fast.

DISCOVER: Next 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x in 2025

Prediction #2: Why This FOMC Feels “Too Priced In”

Here’s the part that worries me: the market is almost unanimous. Fed funds futures price the cut. Sell-side houses are all pushing some version of “25 bps with stern guidance.” Investors are positioned risk-on into 2026, with surveys showing a clear majority expecting higher equities next year and no return to 2022’s chaos.

Whenever everyone thinks they know the script, the Fed usually smacks someone. That could mean:

- A cut combined with dots that crush hopes of multiple 2026 cuts

- Powell leaning hard into “financial conditions are still too easy”

If that happens, the first move after the statement is probably wrong.

DISCOVER: Top 20 Crypto to Buy in 2025

Prediction #3: How We’d Frame It As A Trader

If we were trading this live rather than writing about it, we would:

- Watch “financial conditions” language like a hawk; any hint that the Fed thinks markets got ahead of themselves is bearish risk-on.

- Fade extreme first reactions in indices, especially if the S&P or Nasdaq rip higher on a cut but the dots and tone are tighter than expected.

- Pay attention if Bitcoin sells off while the dollar and real yields rise, that’s confirmation the cut was hawkish in practice.

The Fed can still give us a gentle landing. But walking into a meeting where everyone is sure they are right is usually how someone ends up as the punchline on the chart.

EXPLORE: Seeking a Career Change? Become a Bitcoin Bounty Hunter in Fordow, Iran

Key Takeaways

- Almost all economists are expecting a 25 basis point cut, yet nobody’s confident it will feel bullish. /key_takeaway]

Watch “financial conditions” language like a hawk; any hint that the Fed thinks markets got ahead of themselves is bearish risk-on.

The post What to Expect From FOMC Meeting Today: 3 Expert Predictions For Powell Speech and More appeared first on 99Bitcoins.