President Donald Trump dominated world headlines on March 3, with his $100 billion Taiwanese “investment announcement,” his offer of “fully expedited approvals and permits” for those investing $1 billion into the United States, pausing aid to Ukraine, and implementing 25% tariffs effective immediately upon Mexican and Canadian imports.

While Trump is shaking world markets with these announcements, turns out, that was just a Monday. Trump’s planned and possibly even more world-shaking “cryptocurrency summit” takes place this Friday, March 7.

That event is to be led by Trump’s “Crypto Czar,” David Sachs, who posted that he recently sold all of his personal cryptocurrency investments when assuming the role.

One topic attracting much attention and fierce debate prior to the summit is exactly which digital assets — if any besides bitcoin, that is — should be included in the evolving proposed U.S. digital asset reserve.

Make that, “The Reserve Formerly Known as ‘Bitcoin Strategic,’” but which Trump famously confirmed via a widely circulated Truth Social post on Sunday is now a “Crypto Reserve.”

Much to the disdain and outcry of many bitcoiners, the post affirmed that the altcoins, or “bitcoin alternative” digital currencies — xrp, cardano and solana — will be included in the U.S. reserve, resulting in significant price spikes for them all.

Xrp’s price immediately jumped from $2.23 to $2.92 — 69 cents in just 2 hours, 10 minutes — following Trump’s Truth Social post, for example. This occurred on a Sunday, when traditional markets were closed.

Correctively, Trump quickly followed the post up with another, saying,

“I also love Bitcoin and Ethereum!”

This assured markets that bitcoin would “obviously” be included, he said, and bitcoin’s price likewise jumped from the $85,000 range it had been holding to $94,000 in the hours after the follow-up post.

Trump may have considered his lack (some say failure) of mentioning bitcoin in Sunday’s post not so much an oversight, simply because bitcoin’s place was already a given: Trump had already wooed the bitcoin voting bloc promising the “national strategic bitcoin stockpile” while yet campaigning.

Full Pause, Bitcoiners. We’re Forgetting Something

The move to include the above altcoins was not unexpected.

Multiple recent comments from Trump made it clear that he would be ending the infamous Chokepoint 2.0 banking laws hampering cryptocurrency adoption, and to be “strategically” attempting to pivot the U.S. to become the worldwide industry leader, always emphasizing that the U.S. must beat China to this.

He campaigned not on bitcoin-only, but promised to make the U.S. “the CRYPTO capital of the planet and the bitcoin superpower of the world.” (Emphasis added.)

“If crypto’s going to define the future I want (it to be) mined, minted, and made in the USA … It’s not going to be made anywhere else.”

“IF crypto …” he said. This is a concession, not repentance from his 45th-term on-the-record anti-bitcoin, anti-crypto statements.

He hasn’t seen the light; he’s simply swapped teams, and is presently, sadly, leading the nation through its almost guaranteed-to-happen obligatory shitcoin phase.

Trump is definitely pro-money though, and he’s followed the money to discover bitcoin.

And crypto.

He campaigned on making regulations extremely favorable towards – and here’s the key; especially towards – U.S.-made cryptocurrencies.

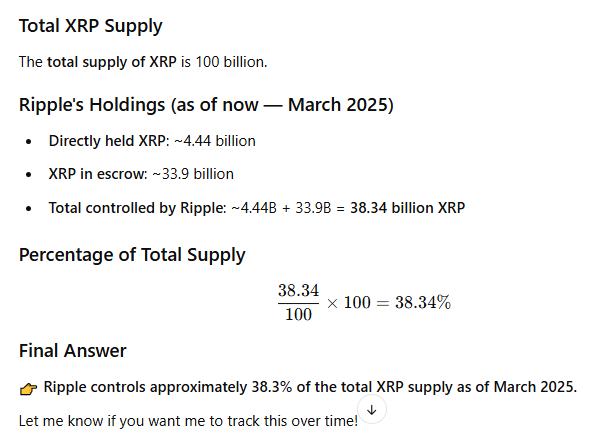

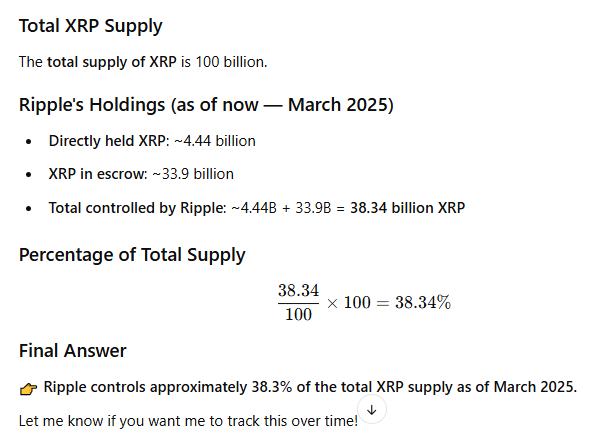

As covered in February by Bitcoin News, the San Francisco-based company Ripple, which owns the vast majority of the xrp token supply …

… and Ripple has long been courting their place at the table within President Trump’s regime.

But many within the bitcoin community consider this a bridge too far, and have become extremely vocal in their opinions of xrp and the U.S. “crypto” strategic reserve.

Leading the Exodus

Especially among the “bitcoin maxi” community, recent debate and speculation has erupted on whether anything but bitcoin, as the campaign promise went, should be held by the U.S., period.

JP Richardson, CEO at Exodus, maker of a popular noncustodial digital asset wallet, designed to accommodate multiple cryptocurrencies, did not mince words in his “straight talk” post:

“This is incredible news for Exodus and our business. This is terrible news for the US. Americans deserve a strategic reserve with bitcoin only.“

User Crypto_Ninja challenged,

“I still don’t understand why you’d post such a one sided view when you’re the CEO of a crypto wallet. I love @exodus wallet but these type of posts just don’t come across supportive of the industry, especially when other assets have already been named for the strategic reserve!“

Richardson elaborated,

“I love the Bitcoin, Solana, and many other networks that innovate. That’s not the issue.

“The issue is that the American taxpayer should not have to foot the bill for altcoins.

“I’m barely comfortable with the taxpayer doing this for bitcoin, but given bitcoin is the best digital store of value, I understand the strategic importance of a nation state owning bitcoin.”

Elsewhere in the thread, he continued with,

“But why stop at XRP, ADA, ETH or SOL? Why not include AVAX or TRX? Where do you draw the line?“

One loyal Exodus user said she wasn’t going to recommend the wallet to anyone anymore, to which Richardson replied,

“… My main point is that the United States strategic reserve should be bitcoin only. Bitcoin is the best digital store of value …”

It turns out that Richardson was merely the first of a cacophony of voices.

Some were loudly arguing either for bitcoin only, or quite specifically against xrp. This is because the company, Ripple, is well known for its drastic public statements, actions and dollars, all spent literally attacking bitcoin over many years.

They made this personal.

Cryptocurrency exchange Coinbase CEO, Brian Armstrong, reposted Crypto Czar Sacks’ announcement of Trump’s announcement of

“… a Crypto Strategic Reserve consisting of Bitcoin and other top cryptocurrencies. …”

Armstrong agreed with the bitcoin-only philosophy for the U.S. reserve as well, saying,

“Just Bitcoin would probably be the best option – simplest, and (a) clear story as (the) successor to gold.”

Ironically, “Bitcoin Historian” Pete Rizzo had just shared a “10 years ago today” post Armstrong made.

It’s no secret that Armstrong has been bitcoin-only all along, considering it the superior asset, echoing Richardson. Yet Armstrong, too, has followed the money all the way to making a fortune from his exchange’s fees on “crypto.”

Armstrong’s former associate and Coinbase former counsel, Hailey Lennon, currently at Fold, stated,

“I believe in a free market. People should be free to buy any tokens they want. Companies should be able to launch any tokens they want.”

“But when it comes to the strategic reserve, I want it to be good for America and Americans. I believe the best way to achieve that is bitcoin.”

Making this already cold day in hell freeze over entirely, enemies became frenemies when famous goldbug Peter Schiff, known for famously dunking on bitcoin for years, came to bitcoin’s defense! Against xrp, anyway.

Schiff appeared genuinely appreciative of the strategy behind a bitcoin reserve, comparing the concept to U.S. oil and gold reserves, and asked quite directly,

“But what’s the rationale for an XRP reserve? Why the hell would we need that?”

Schiff has made many comments on the topic since, including,

“It’s wrong for governments to pick winners and losers. It’s always best to let the market decide. Central government planning has never worked.

“Even if Trump thinks crypto will end up being an important industry, he shouldn’t stockpile crypto with taxpayer money to subsidize it.“

Industry leaders continued to chime in all day, prompting Bitcoin News to humorously post about the “new maximalists” being born of the schism.

Perhaps not humorously at all, Yahoo! Finance took the position that another recent bitcoin price dip was allegedly attributable to the controversy, posting an article titled “Bitcoin plummets $10,000 in a day as crypto leaders trash Trump’s plan” (emphasis added).

The Tuesday article stated that bitcoin had …

“…tumbled from $93,000 to $83,000.

“This is all because of President Donald Trump’s proposal to establish a strategic cryptocurrency reserve — a pivot from his earlier stance of exclusively stockpiling Bitcoin.

“The shift didn’t sit well with crypto leaders, who swiftly pushed back. Their stance is clear: if there’s going to be a reserve, it should be Bitcoin-only.”

… the internet-based news site said upon discerning the clear message being sent by even “the crypto community” itself.

Yahoo noted that Gemini cryptocurrency exchange owners, Cameron and Tyler Winklevoss, who “donated millions to support Trump’s election campaign,” apparently “are upset.”

Interestingly, the bitcoin community’s (increasingly suspect?) “go-to guy” for authoritative answers to bitcoin topics, tech giant Michael Saylor, who wants the U.S. to buy 4-6 million bitcoin, was not at his bitcoin maxi best on this one, as noted by Pledditor:

“Saylor refused to say that the US Strategic Bitcoin Reserve should be bitcoin only.”

While allowing other assets into the strategic fund is not what many bitcoiners wanted to hear, Saylor deferred to Trump’s decision as president, saying,

“I’m not surprised … There’s no way to interpret this as other than this is bullish for bitcoin, and is bullish for the entire U.S. crypto industry …”

“I believe that the best thing for the country is to move forward with an enlightened, progressive policy towards digital assets.

“I think it’s worth $100 trillion to the United States.”

Ripple’s Garlinghouse, as usual, kept his “let’s buddy up” and “water level rising” game face on, trying to include himself by asking everyone else to “work together.”

“Bitcoin Twitter,” as usual, responded by manifesting through Wojak Bitcoin Memes:

There Is No Second Best

Cryptocurrency trading is for making quick gains by buying low and selling high: Some have made lots, the majority loses big, is the bitcoin maximalist experience and view.

Bitcoin is a commodity. Like gold or oil, nobody really controls it, and is subject mostly to supply and demand.

All other “digital assets” essentially have CEOs and marketing teams, and they can almost all be shut down at any time. Trading in them is more akin to “flipping houses” than it is to holding bitcoin.

Privacy coins aside perhaps, the goal of “being in crypto” is to get in and get out.

I have personally said many times in my real life that I know that if I help a friend with self-sovereign bitcoin ownership, 10 years from now, we’ll still be friends.

Anything else, though? Not so much. Don’t ask, I won’t help you with that.

Bitcoin is for building wealth long term; its indisputable track record proves this. Nobody holding bitcoin for more than five years has ever sold at a loss. While campaigning, Trump even said it himself, “Never sell your bitcoin!“

If the goal of the U.S. strategic reserve truly is to build long-term wealth, then bitcoin-only is the only choice.

The price of “cryptos” trends towards zero over time, and much faster when viewed through the lens of bitcoin, instead of dollars.

Taxpayers don’t want (Yes, I asked them) to fund the family fortunes of white guys in suits benefitting from legalized money laundering by watching the government buying crypto tokens with our hard-earned money to pump the bags of early insiders.

That’s not bitcoin, that’s crypto, and we don’t want any.

The inclusion of xrp, altcoins and “even them American-made crap-toes” is not strategic.

Make two reserves: one a bitcoin-only reserve and one a crypto reserve, and then let’s compare them in five years. And 10, 20 …

We’ve done the work already; we know how this chart ends. We kind of dare you, in fact, to prove us right. Track that chart live on nightly news as the nation and the whole world watches what happens.

Please. I’m begging.

Bitcoiners voted for a national bitcoin strategic stockpile, and regardless of how long it takes for Congress and the “crypto committees” to learn their lesson by getting publicly rekt, Americans will have our bitcoin strategic reserves in our states, in our cities, in our businesses and our own hardware wallets.

Thank you, Mr. President, for making sure that self-custody of bitcoin is not a crime, and especially sir, thank you for freeing Ross Ulbricht — promises made and kept.

America’s in your capable (God, we hope) hands. We’re going to get back to fixing the world by fixing the money now, as we were before you came along.

You can go have fun playing with your crypto.