MOVE soared to a 2-month high as it parted ways with a malicious market maker, which triggered a renewed interest among whales.

According to data from crypto.news, Movement (MOVE) surged 32% to an intraday high of $0.594 on March 26 afternoon Asian time, while its market cap stood at $1.36 billion. Its daily trading volume also surged 7-fold over the period, reaching around $829 million.

Most of today’s gains came after the Movement Network Foundation announced it had recovered around $38 million in USDT from a now-banned market maker that had been operating on Binance.

The entity was originally brought in to provide liquidity for MOVE on the platform by placing buy and sell orders to help stabilize the price and support healthy trading. However, the market maker turned malicious and dumped 66 million MOVE tokens shortly after the token’s listing on Binance while placing almost no buy orders.

Binance flagged this behavior as “market irregularities,” froze the market maker’s profits, and removed them from its platform.

Movement Foundation, which has severed ties with the firm, has committed the full $38 million to a three-month buyback program called the Movement Strategic Reserve. Basically, they’ll be buying MOVE from the open market to ease selling pressure and pump more liquidity back into the ecosystem.

The buyback news kicked off a wave of whale accumulation.

On March 24, wallets holding between 100 million and 1 billion MOVE had about 553 million tokens. As of today, that number’s shot up to 953 million, meaning whales scooped up around 400 million MOVE in just the past 48 hours. At the current price, that’s over $185 million worth of tokens.

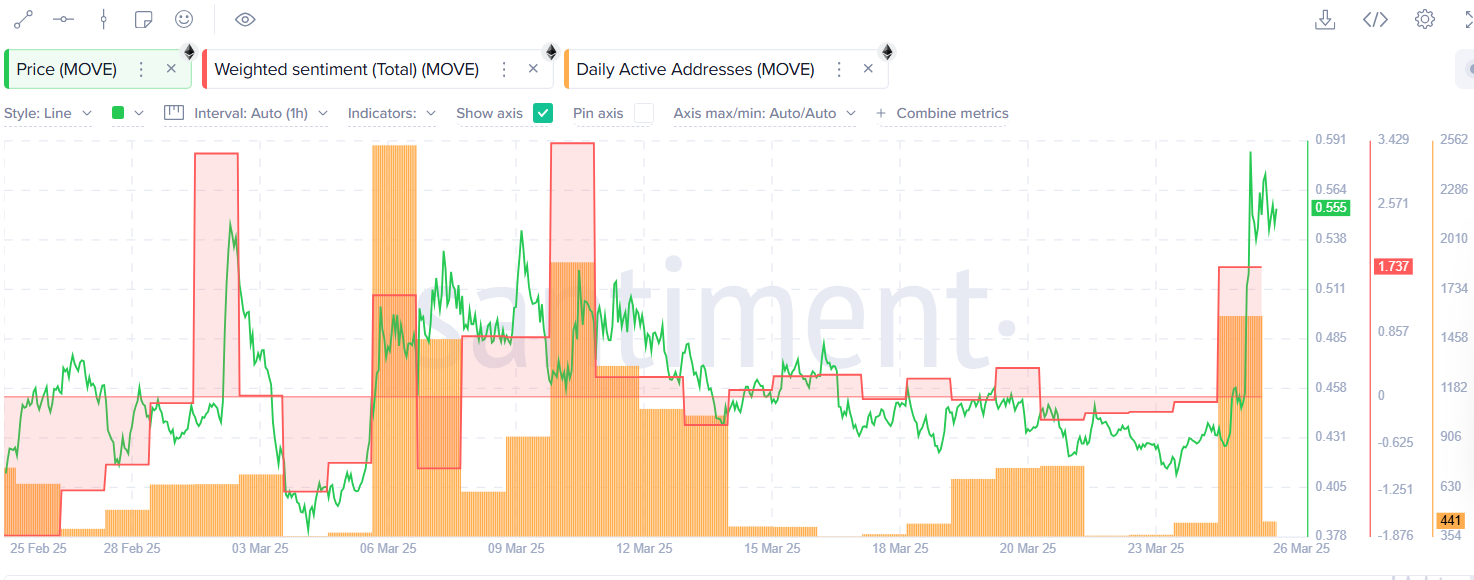

On-chain metrics are also looking strong. Daily active addresses spiked by 265%, and social sentiment has flipped to positive over the past day.

MOVE price analysis

On the 1-day/USDT price chart, MOVE has broken out of a multi-month falling wedge pattern, which is usually a bullish reversal signal and could mean a longer rally ahead.

The MACD and Super Oscillator lines are both pointing up, which confirms that the momentum is shifting in favor of the bulls and points to more upside in the short-term.

Additionally, the Money Flow Index stood at 65, showing that buying pressure is picking up, but there’s still room for more before it hits overbought territory.

Given these positive signs, MOVE could rally to its psychological resistance at $0.90, 65% above current levels. This has also acted as a key resistance level for the altcoin. A break above this mark could push it to target its yearly high of $1.12.

However, if MOVE breaks below the lower trendline of the wedge, the setup might be invalidated. In that scenario, the altcoin’s value might sink to $0.37.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.