The Altcoin ETF race is heating up as Pyth crypto could be next in line following Grayscale’s reveal of a Pyth trust, which could precede ETF.

Grayscale Investments is back in the spotlight with the debut of its Pyth Crypto Trust.

Dedicated to the Pyth Network on Solana, this latest addition to Grayscale’s crypto fund lineup signals increasing demand for blockchain-based assets and cements Pyth’s position as an emerging DeFi powerhouse.

What Is the Grayscale Pyth Trust?

Grayscale Investments has launched the Pyth Trust, aimed at offering exposure to the Solana-driven Pyth Network governance token. This fund continues Grayscale’s streak of focusing on single-asset products and now brings eligible investors closer to Solana’s ecosystem via daily subscriptions.

Built as a decentralized oracle, the Pyth Network integrates real-world data like asset prices into blockchain systems, creating crucial backend tools for DeFi. Running 95% of Solana’s applications, Pyth remains indispensable to the network’s functions.

This move demonstrates Grayscale’s long-game understanding of decentralized infrastructure. With Pyth’s precise data feeds sourced from traders and market makers, the trust taps into an essential layer powering DeFi’s architecture.

Grayscale Is The Shepherd of Altcoins: Why the Pyth Trust Matters

Fresh off launching funds tied to Dogecoin and crypto mining performance, Grayscale is doubling down on investor demand for niche blockchain plays.

This explosion of interest follows the SEC’s approval of spot Bitcoin ETFs in early 2024, which triggered billions in inflows across crypto funds. Ethereum-focused products have also surged, creating the perfect storm for Grayscale to expand its crypto arsenal.

Is the Solana Ecosystem Collapsing?

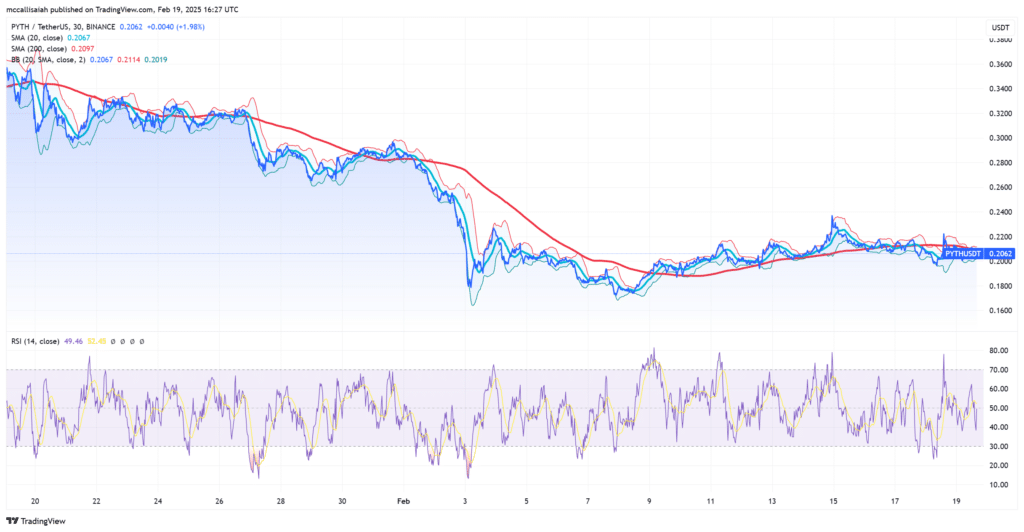

The Solana market is in a bear market, showing poor performance compared to BTC, for example

The Solana Ecosystem is an index composed of 11 cryptocurrencies: RENDER, WIF, JUP, W, BONK, PYTH, BOME, GMT, RAY, JTO, and TNSR.

Chart: @Alphractal pic.twitter.com/Xrq4ZSjbyP

— Joao Wedson (@joao_wedson) February 19, 2025

The Pyth Trust does more than offer a new investment angle. It showcases Solana as a DeFi powerhouse, something criticized in recent weeks, with Pyth as the lifeline for most of its decentralized apps.

By spotlighting this critical oracle system and Chainlink competitor, Grayscale connects investors to the backbone fueling growth in blockchain finance.

A Promising Step for Altcoin ETF Push

The Grayscale Pyth Trust underscores a shift in crypto investing. It’s no longer just about accumulating coins but digging into the tech fueling the next wave of finance. This launch offers investors a direct stake in decentralized innovation, tapping into a growing appetite for blockchain’s potential.

Demand for forward-thinking blockchain products continues to climb, and the Pyth Trust fits snugly into Grayscale’s expanding lineup.

EXPLORE: XRP Price Jumps 11% After SEC Crypto Unit Tease XRP ETF Progress

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Key Takeaways

- The Grayscale Pyth Trust marks a significant moment for both crypto infrastructure and investment.

- By spotlighting a decentralized oracle like Pyth, the fund emphasizes the foundational importance of reliable data feeds in blockchain ecosystems.

- At the same time, it provides investors with a unique route into Solana’s rapidly maturing network.

The post Is a PYTH Crypto ETF Next? Grayscale Just Launched a Pyth Trust appeared first on 99Bitcoins.