Most people don’t get Bitcoin right away. It’s not because they’re dumb. It is because money itself is a weird, broken system that we’re all just used to.

Dave Birnbaum was no exception. When he first encountered Bitcoin in 2013, he wasn’t thinking about decentralization, censorship resistance, or the future of finance.

He was just a guy getting paid for a web design gig, except, instead of cash, he got an entire bitcoin. At the time, it was worth about $600.

Like most early adopters, he didn’t hodl. The price jumped, he sold, and he walked away thinking he made a solid trade. Now? He laughs at himself for that mistake. But that wasn’t the end of his Bitcoin story. It was just the prologue.

Today, Dave is VP of Product at Coinbits, a company on a mission to solve one of Bitcoin’s biggest paradoxes: How do you make a censorship-resistant, decentralized protocol feel as easy as Venmo?

While most of Silicon Valley chases walled gardens and surveillance capitalism, Coinbits is tackling Bitcoin’s biggest usability problems without watering down its core principles.

Their approach is a human-first design, built by a team with deep experience in gaming, VR, and touch interfaces.

From Touchscreens to Trustless Money

Before diving into Bitcoin full-time, Dave spent years in Silicon Valley working on ways to make technology feel more real.

He believed user interfaces should engage more than just thumbs and eyeballs. “People say ‘go touch grass’ when you’re too online, but what if digital spaces actually felt real?” he says.

That obsession with intuitive design followed him into Bitcoin. By 2017, the “crypto” circus was in full swing with ICOs printing money out of thin air, centralized altcoins cosplaying as decentralized, and Bitcoin locked in a civil war over its blocksize.

“Back then, being a Bitcoin maximalist was like defending a burning castle,” Dave jokes. “You needed irrational conviction.” But as the smoke cleared, Bitcoin emerged as the only protocol able to offer sound money for the world.

The rest evolved from innovation theater to memecoins. Which, to be fair, at least memecoins are honest about what they are.

Bitcoin’s Usability Trap

Bitcoin’s greatest strength – its trustless, unbreakable architecture – is also what makes it intimidating for newcomers. Engineers built the plumbing but forgot the faucet.

“Most products get 90% finished by coders before anyone asks, ‘Will a human actually use this?’” Dave explains. The result is that more often than not, people freeze. They stress over unit bias (“I can’t afford a whole coin!”) or panic about losing their private keys.

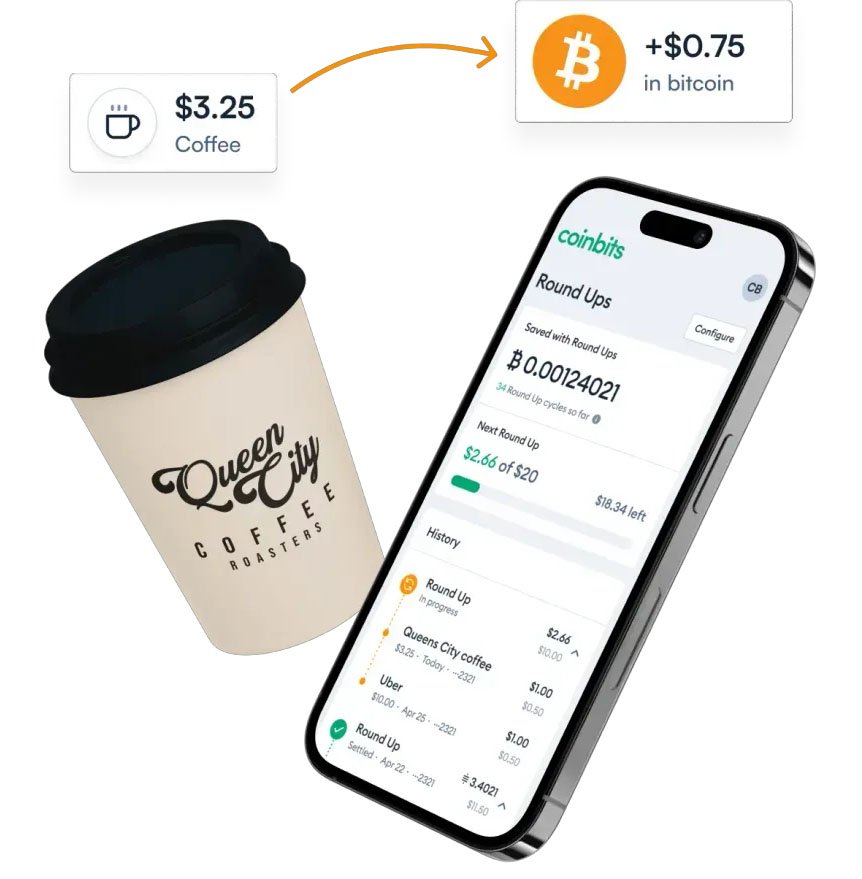

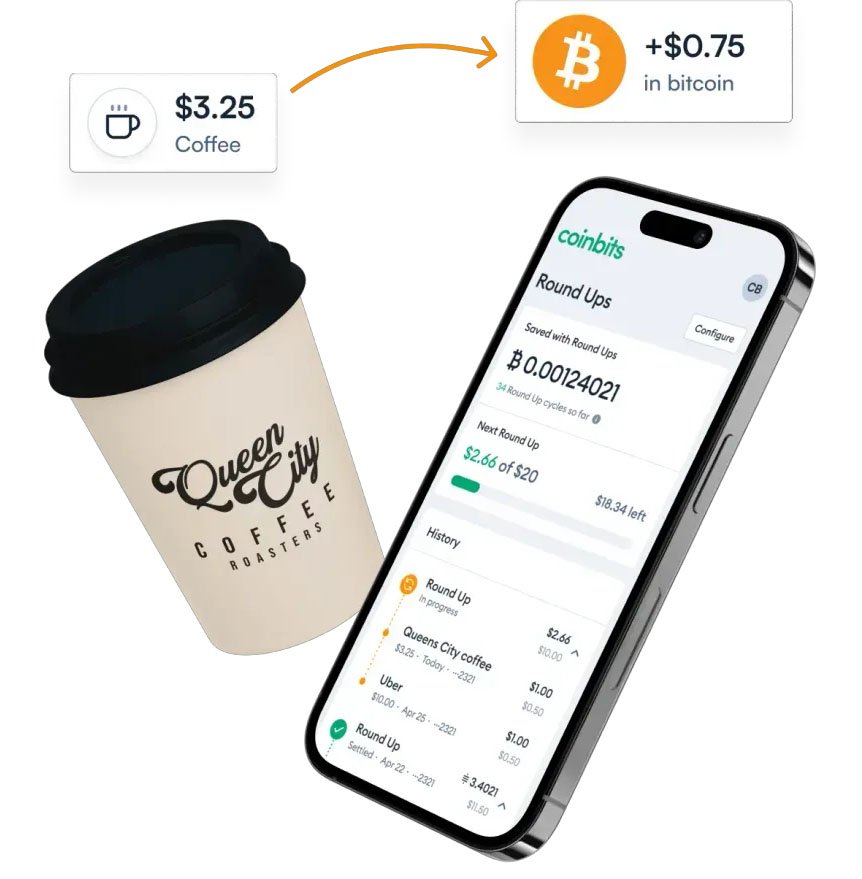

Coinbits is trying to fix this by removing decision fatigue. Instead of asking people to “buy bitcoin,” it automates savings through roundups. Link your card, and your spare change automatically flows into bitcoin: no charts, no market timing, no stress.

“You don’t have to pick between $5 a week or $100 a month. Just live your life and watch your stack grow,” says Dave. It’s the digital equivalent of a loose change jar, except instead of fiat rotting in your sock drawer, it’s stacking the hardest money in history.

The Custody Conundrum

Buying bitcoin is easy. Keeping it safe is where most people tap out.

“Even tech-savvy folks struggle with hardware wallets,” Dave groans. “Try explaining seed phrases to someone who doesn’t know how to copy and paste on a smartphone.”

That’s why most people leave their bitcoin on exchanges. Not because they want to, but because self-custody still feels like defusing a bomb with a blindfold on for most who are not familiar with Bitcoin.

Coinbits is tackling this head-on.

While Dave stays tight-lipped on specifics, he teases “multisig solutions that go beyond today’s options.” His team is working on a way to make self-custody foolproof without compromising security. No cryptography PhD required.

Lightning, AI, and the Death of Ads

Beyond fixing Bitcoin’s onboarding problems, Dave sees something bigger on the horizon: Bitcoin obliterating the internet’s broken economics.

“The ad model is a zombie,” he says. “Why stalk users when Lightning lets them pay for content directly?”

Imagine AI services charging per query instead of locking you into subscriptions, or bloggers earning sats instead of selling your data to advertisers.

When payments become instant and frictionless, the internet doesn’t need surveillance to function. “When value flows peer-to-peer, surveillance capitalism dies,” Dave argues.

No Magic, Just Momentum

Coinbits isn’t trying to reinvent Bitcoin. They’re just making it easier to use; Smoother onboarding, smarter custody, and a relentless focus on frictionless UX.

“Bitcoin is not ‘too late’ or ‘too complicated’ — that’s just bad design talking,” Dave says. His North Star is helping people realize they don’t have to understand everything about Bitcoin to start stacking.

Bitcoin adoption won’t be driven by maximalist sermons or technobabble. It’ll happen when someone links their debit card, forgets about it, and months later realizes they own a slice of the hardest money in history.

“We’re not here to make you a Bitcoin expert,” Dave grins. “We’re here to make you a Bitcoin owner.”

And sometimes, owning just a little bit is all it takes to fall all the way down the rabbit hole.