“It’s actually smarter if you’re young enough to accumulate as much debt as you possibly can and buy bitcoin with it.”

So says Brad Mills, Canadian entrepreneur, angel investor and YouTuber, who has been involved with bitcoin mining since 2011 and is therefore well acquainted with bitcoin’s price volatility.

On Friday, Mills posted an apparently unscripted yet well-thought-out two-minute conversation, encouraging what can only be called “irresponsibly long” bitcoin-buying behavior.

Continuing, Mills said to accumulate as much debt as one can,

“… And hold the bitcoin for as long as you can … (and) just negotiate with the credit card companies.

“If you’re in a position where you don’t care, and the housing is too expensive anyways. Like, you’re a young person and you kind of feel like screwed over by the system. Well rightfully so, they screwed you.

“So, why would you want to go get a great credit score, and try to buy this crazy overvalued house and pay this insane mortgage to the bank? They’re making the money up from nothing anyway and they’re just using you as profit meat.

“I say, it’s probably smarter for you to just do whatever you possibly can to acquire as much bitcoin as you possibly can and hold for as long as you can.

“And whether that’s negotiating with the creditors … to try and elongate your repayments: That’s probably … smarter than building up a credit score … and being a debt slave for the rest of your life. …

“It might be a little bit controversial, but I think bitcoin still has another, like, 100x in it potentially over the next few decades. So if you’re thinking about it on a long enough timeframe, you’re not going to need credit. …

“You’ll have enough hard asset value from the bitcoin that you own that you’ll be able to borrow against your bitcoin in an alternative financial system that doesn’t even use credit.

“Credit is like a wool that’s pulled over everybody’s eyes to keep you from seeing that the money’s broken. ….” Mills said.

The post has received over 150 comments and almost as many shares.

As controversial or irresponsible as such a plan might seem at first, Mills challenged, “Where’s the hole in this logic?”

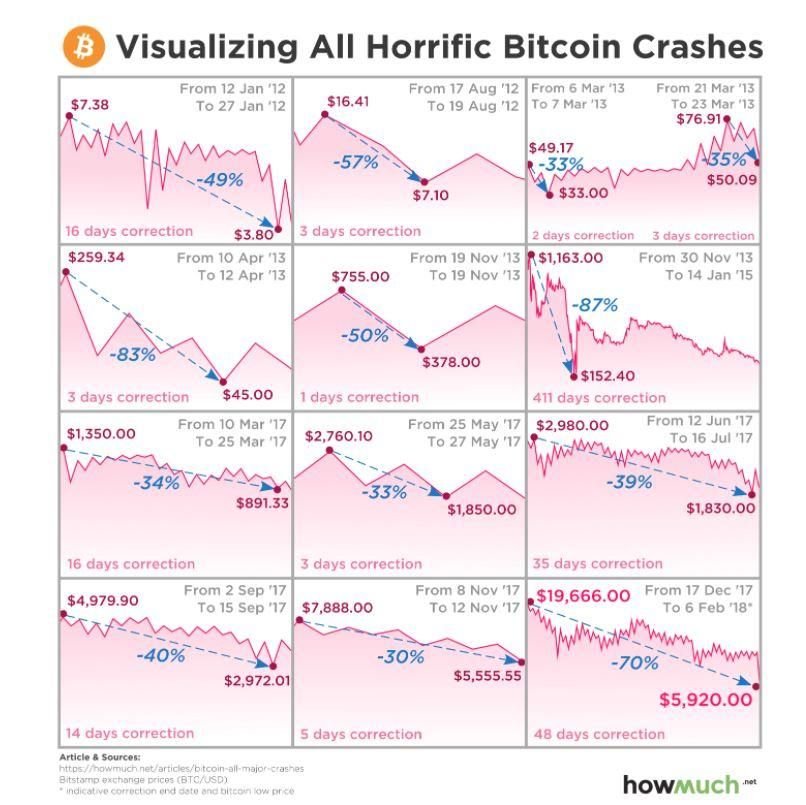

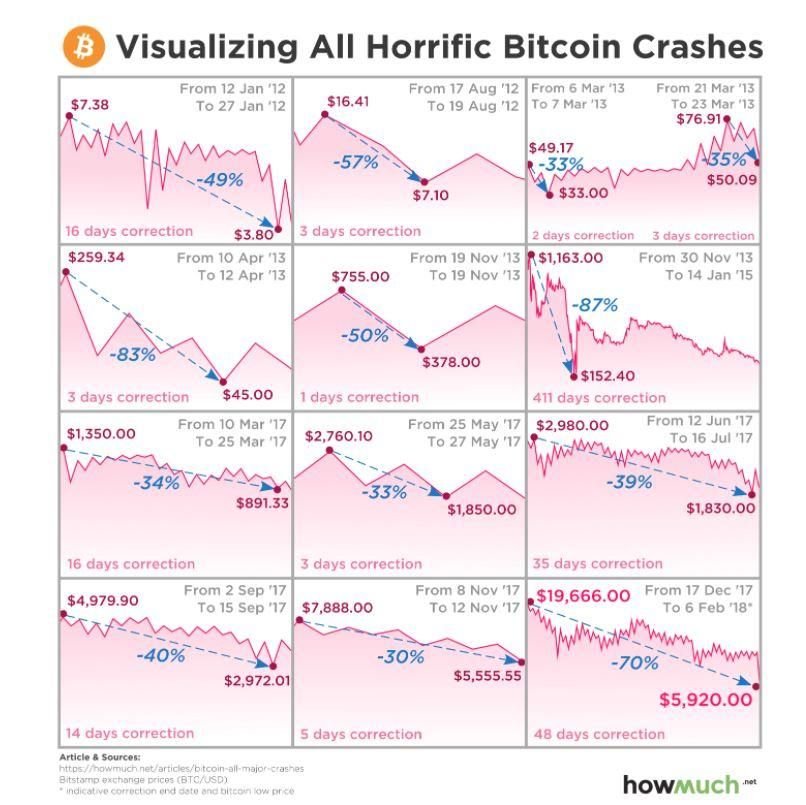

Bitcoin’s price has indeed dropped dramatically several times — over 80% at some points in its history.

But to date bitcoin’s price has always recovered, going from mere pennies to a selling price of over $100,000 per unit, even recently rebounding from such a dip by regaining $10,000 in less than 24 hours.

“Are ya winning, Sunny?”

One X user, Sunny Po, acted on his belief in this trend’s presumed continuance by putting his excellent credit to the test: 14 months ago, he began his own experiment of doing exactly what Mills suggests — maxing out his credit cards to buy bitcoin, or, as Po himself described, “going full send Saylor.”

Po is referencing Michael Saylor, who steered the company now doing business as Strategy (formerly MicroStrategy Incorporated) to repeatedly incur enough corporate debt to purchase nearing 500,000 bitcoin to date.

Saylor was ridiculed by the Wall Street Journal for his “Bet on Bitcoin,” which has since turned out quite well for the company.

The company first purchased approximately $250 million worth of bitcoin with its own cash reserves, at an average price of around $11,650 each, and has continued by issuing corporate debt to keep buying more and more bitcoin.

ChatGPT estimates the company is currently sitting on a total “unrealized profit of around $14.6 billion” in price appreciation since placing its bitcoin bet.

Other companies that have recently likewise utilized corporate debt strategies to acquire bitcoin include Block, Cantor Fitzgerald, Hut 8, MARA Holdings, Riot Platforms and Tesla, to name a few, as has the country of El Salvador.

Po has regularly documented for X users via meticulous spreadsheets that he similarly bought over $50,000 worth of bitcoin on his personal credit cards — all at 0% interest and at an average price of around $37,000.

At the end of each month, Po posts updates:

He stated in this post on Jan. 31 that his unrealized profits-to-date total is $94,375 since December 2023.

One user replied to Po that his plan was “the nuttiest (expletive) I’ve ever seen …” to which Po replied “You should see the National debt then.”

Po pays the $542 in monthly credit card bills from his “day job income,” he posted when asked, and reminds others that his experiment was undertaken at 0% interest.

Unlike other purchases often made with credit, like homes or cars, bitcoin can be immediately liquidated in fractional quantities and money sent straight to a user’s bank account.

If Po found himself disabled from earning or somehow short on his ability to meet his monthly credit card payments, selling a little bit of his bitcoin each month would be all that’s required to maintain the payment plan, without him actually working.

It should be noted since he would today be selling at at least two or three times his original costs that a capital gains tax would apply to the profits from the bitcoin he sold, making the matter a little less simple than just “paying down credit cards,” while also affecting his profitability.

$1 Million Bitcoin?

Saylor has predicted bitcoin’s price going anywhere from $3-$49 million per unit by the year 2045.

Longtime bitcoin-focused Ark Invest’s CEO Cathie Wood makes frequent news appearances presenting the company’s “base case for bitcoin,” claiming that it will reach at least $1 million by 2030, perhaps even $1.5 million.

To see $1 million bitcoin would be about 10x from today’s price of around $100,000 and then another 10X away from Mills’ guess of 100x “potentially over the next few decades.”

A 100x return on bitcoin purchased in today’s market would require a $10 million bitcoin to prove him right.

$10 million bitcoin is well within Michael Saylor’s $3-49 million 21-year prediction range, above, and tracks with Cathie Woods’ stated $1 million prediction in just over five years from now.