Is the Bitcoin bull run over? BTCUSD crashes below $80,000 as sellers dominate, erasing Q4 2024 gains. Will BTC bears dominate in Q2 2024?

There has been a harsh shift in the Bitcoin and crypto markets. Despite high optimism and assertions by believers that the recent dip is just an ordinary correction and buyers are in control, prices continue to crash below critical support levels.

Bitcoin Price Analysis

After the April 2 announcement by Donald Trump and the beginning of reciprocal tariffs, the Bitcoin price temporarily spiked to $88,500 before crashing hard, breaching $85,000.

Since then, it has been one-way traffic, with sellers in charge, forcing the world’s most valuable coin below the psychological $80,000 mark. At this pace, not only will BTC/USD slip below Q1 2025 lows, but there is a real risk of the coin plunging to 2021 highs of around $74,000, heaping pressure on even some of the best cryptos to buy in 2025.

When that happens, sellers would have reversed all gains of Q4 2024, and the possibility of another leg down toward $50,000 will be on the table.

Technical candlestick arrangements on the BTC/USDT daily chart paint a grim picture. The immediate local resistance is at $90,000, while the zone between $75,000 and $78,000 is a support area.

For the uptrend to take shape, buyers must step in at current spot rates, scooping up BTC at a discount. However, if sellers press on today, Bitcoin and the broader crypto market may crack, extending last week’s losses as sellers target fresh 2025 lows.

Is the BTC/USD Bull Run Over?

It’s a possibility that cannot be dismissed outright and may crash expectations—especially for holders of some of the best meme coins to buy.

As the Bitcoin stumble amplified fears, Ki Young Ju, the co-founder of CryptoQuant, posted on X, saying the Bitcoin bull run may now be in the rearview mirror.

Unfortunately, the market tone remains bleak at press time, and current market data spells more than just a correction.

In Ju’s view, there are signs that this is the end of the bull cycle that lifted valuations to record highs in 2024. Looking at key on-chain data, Ju argues that solid evidence shows that Bitcoin bulls stand no chance and the uptrend is over.

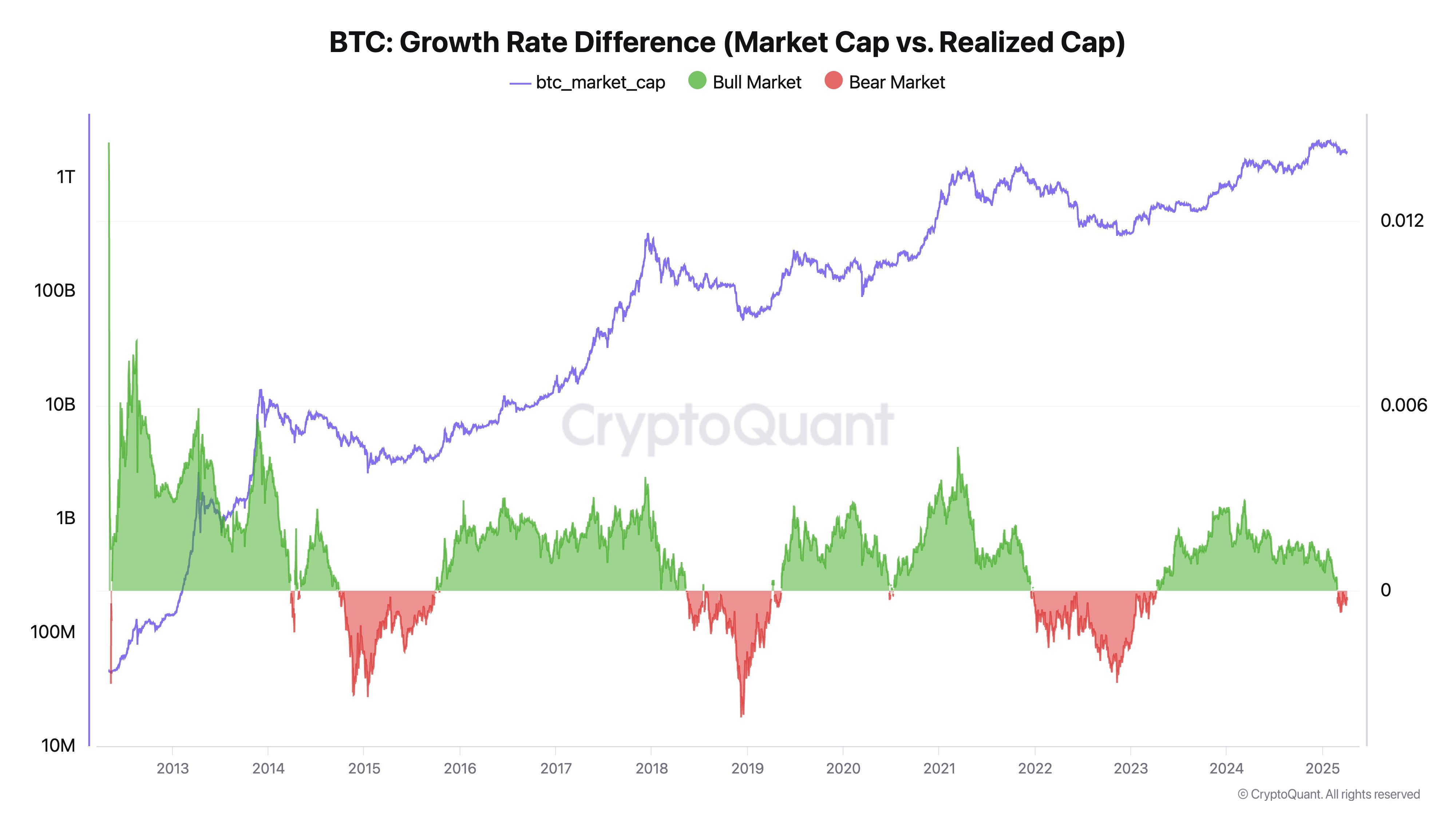

Central to his analysis are the key changes in the realized cap.

EXPLORE: Best New Cryptocurrencies to Invest in 2025

Capital Flowing To Bitcoin But Prices Stagnant

Unlike the market cap metric, which multiplies the current price of BTC by its circulating supply, the realized cap measures something else.

It calculates the total price of Bitcoin based on when coins were last moved on-chain. Simply put, the realized cap measures the amount of capital entering the market and is anchored on wallet behavior.

(Source)

Ju said the realized cap is more like a “thermometer for real money moving into Bitcoin.”

He added that the realized cap is rising, but the market cap is stagnant and falling. That fresh capital is entering, but the market cap is not moving, which is a bearish signal, showing that although buyers are stepping in, the weight of selling is too strong for the market to advance.

In a bullish market, if the realized cap were rising, the market cap would expand sharply, reflecting buyer interest.

“In a true bull market, small amounts of capital drive large price movements. When that dynamic reverses—when large capital inflows can’t move the needle—it means we’re already in a bear market,” the analyst noted.

EXPLORE: 10 Best AI Crypto Coins to Invest in 2025

Has Bitcoin Crossed the Line?

In a separate post, another analyst added that, based on NUPL (Net Unrealized Profit/Loss) and SOPR (Spent Output Profit Ratio), real sales pressure typically emerges around 800 days after the bullish cycle begins.

“We’ve now hit the 800-day mark,” the analyst said, “historically, that’s when genuine selling begins.”

(Source)

Interestingly, the analyst added that selling pressure can take over 1,000 days to manifest during bullish rallies without black swan events.

However, the pressure appears to be mounting because of macroeconomic stressors such as tariffs and high rates.

The good news is that Bitcoin is resilient. Despite tremors, there have been no market collapses, thanks in part to corporate buying that is stabilizing the market.

For the first time in history, bitcoin is not moving in lockstep with the stock market. It’s now behaving like a hedge to geopolitical uncertainty. When the stock market plunged during Covid, so did bitcoin. And this was always case over the last 10+ yrs. But not this time.…

— Tyler Winklevoss (@tyler) April 6, 2025

Tyler Winklevoss of Gemini added that Bitcoin is also emerging as a hedge against political uncertainty.

DISCOVER: 16 Next Crypto to Explode in 2025: Expert Cryptocurrency Predictions & Analysis

Bitcoin Bull Run Over? BTCUSD Price Analysis Shows Shift In Sentiment

- Bitcoin price drops below $80,000 as sellers take charge

- Bitcoin realized cap shows capital inflows failing to lift market cap

- BTCUSD technical analysis: BTC resistance at $90,000

- Will corporate Bitcoin buying stabilize prices and make BTC a hedge against political uncertainty?

The post Bitcoin and Crypto Bull Run Officially Over? BTC Drops Below $75,000 appeared first on 99Bitcoins.