Bitcoin market took a big hit this weekend after Trump signed an executive order slapping new tariffs on Canada, Mexico and China. The move sent markets into a tailspin with bitcoin dipping below $100,000, wiping out billions from the space.

On Saturday Trump followed through on his campaign promise and imposed steep tariffs on major trading partners. His executive order put a 25% tariff on imports from Mexico and Canada and a 10% tariff on goods from China. He cited drug trafficking, particularly fentanyl, as the reason.

“The sustained influx of illicit opioids and other drugs has profound consequences on our Nation,” Trump said in his executive order. These tariffs will stay in place until these countries take serious action to stop the fentanyl from coming into the U.S.

The tariffs go into effect Tuesday at 12:01 a.m. and have already prompted swift retaliation from the affected countries.

Mexico’s President Claudia Sheinbaum announced her country would impose its own tariff and non-tariff measures. Canadian Prime Minister Justin Trudeau also announced a 25% tariff on a range of U.S. goods and warned of further actions that could impact the U.S. energy sector.

The bitcoin market didn’t wait. BTC which was just above $106,000 dropped below $100,000 as investors panicked over a trade war. Altcoins got hit even harder with major tokens going down 6-8%.

In 24 hours over $500 billion was wiped out of the entire digital assets market. Over $700 million in leveraged positions were liquidated with longs taking the biggest hit.

With traditional markets closed over the weekend bitcoin and other digital assets were the first to respond to Trump’s tariff announcement.

The big drop in bitcoin has traders and analysts split on what’s next. Some think the tariffs will ultimately be good for bitcoin as a hedge.

“You simply have not yet grasped how amazing a sustained tariff war is going to be for Bitcoin in the long run,” said Jeff Park, head of alpha strategies at Bitwise.

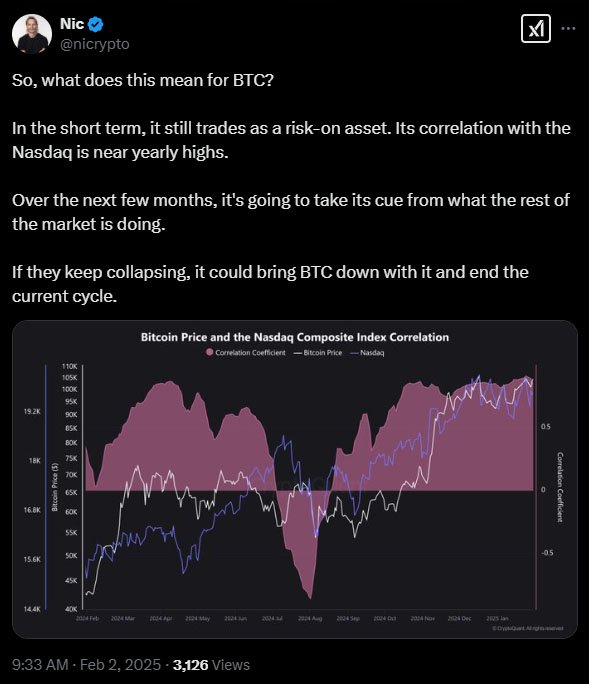

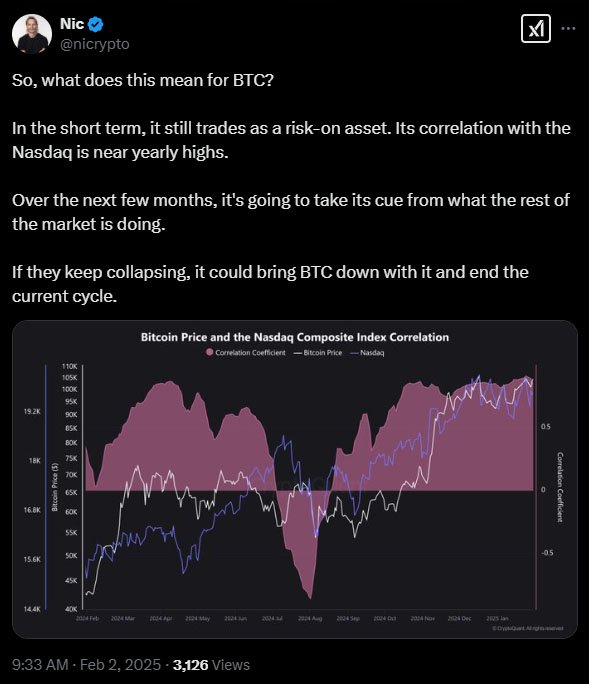

But others think the short term effects could be worse. Nic Puckrin, CEO of Coin Bureau, said liquidity shocks and market wide risk aversion could bring bitcoin down even further in the short term.

“Bitcoin still trades as a risk-on asset,” Puckrin said. “If markets keep collapsing, it could bring BTC down with it and end the current cycle.”

Analysts are waiting to see what happens next. Many think bitcoin needs to hold above $97,000 to stay bullish. Analyst Ali Martinez says $97,190 is the level to watch. Above that and we could see $110K, below and we could see a deeper correction.

Despite the uncertainty, some big names are still bullish.

Robert Kiyosaki says a bitcoin crash could present a good buying opportunity.

Kiyosaki has been saying bitcoin will be between $175,000 and $350,000 by the end of 2025 and sees long term value in the digital asset as the economy gets more uncertain.

Historically bitcoin has done well in February, especially in post-halving years. Since 2013 bitcoin has never closed February in the red, averaging 15% gains.

But the tariff inflation risk might kill the trend. Economists say Trump’s tariffs will increase prices for US consumers, inflation and delay interest rate cuts from the Fed — which will hurt bitcoin.