As the new week begins, crypto news today continues to cause fear and uncertainty in the market, with Bitcoin dropping -0.8% overnight and losing its crucial $90,000 support level. The fear and greed index remains firmly in the ‘extreme fear’ zone at 16, as traders continue to lose hope amid this longstanding bearish price action.

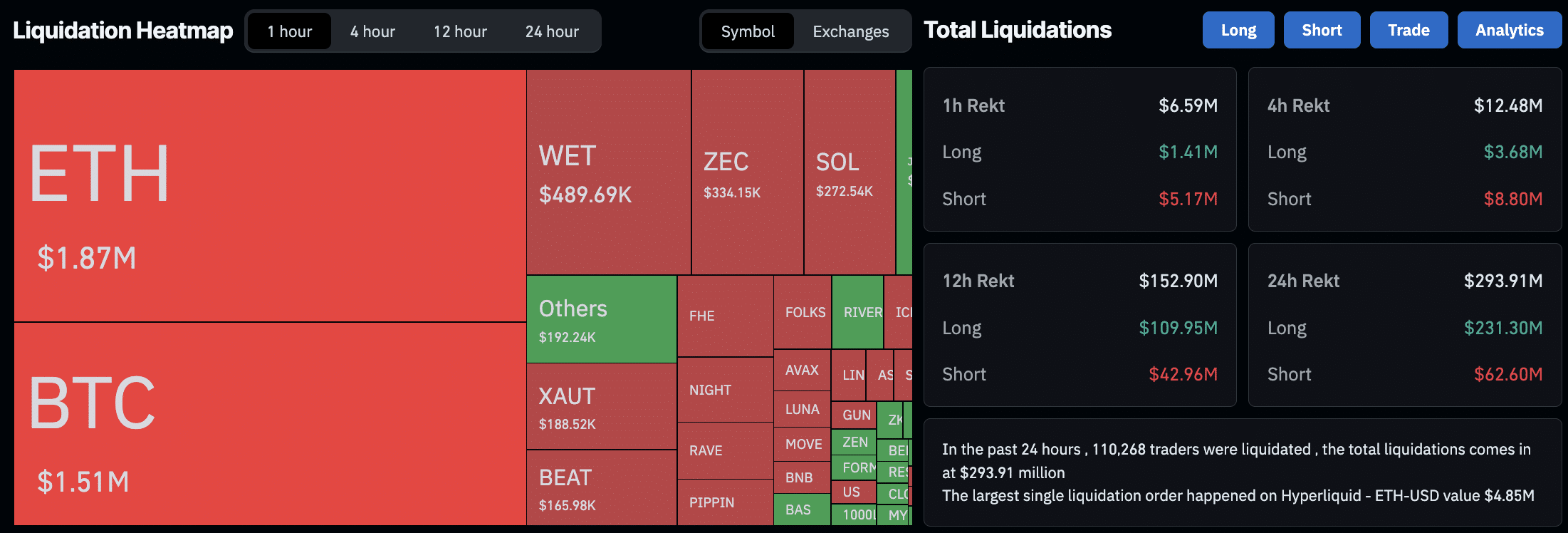

According to CoinGlass data, over $293M in leveraged positions has been wiped out over the last 24 hours, with $231M from long trades and $62M from short trades. This indicates bears are in control, but bulls remain optimistic and are still attempting to go long in the market.

Many are left wondering whether this price action is organic or part of a wider manipulation event, as just last week Bitcoin surged back above $94,000 as news broke that the US Fed would be cutting interest rates by 25 bps, which many believed would cause a flurry of investment into risk-on assets such as crypto.

The bounce was seemingly short-lived as Bitcoin is back under $90,000, and over $100Bn has been wiped out of the entire crypto market cap since Friday (December 12). Let us examine today’s crypto news and assess why the market is responding so poorly to current global macroeconomic conditions.

Crypto Fear and Greed Chart

1y

1m

1w

24h

DISCOVER: 16+ New and Upcoming Binance Listings in 2025

Crypto News Today: Is the Market Downturn All Due to Japan’s Expected Rate Cut on December 19?

On December 19, the BoJ (Bank of Japan) is expected to raise its interest rates by 25 bps, less than two weeks after the US cut its own rates by 25 bps. Many market participants are scratching their heads, wondering why a rate hike in Japan would affect crypto so heavily.

However, Crypto Twitter trader @misterrcrypto has posted a Bitcoin chart on X, highlighting the last time the BoJ raised interest rates, in August 2024. It resulted in BTC falling from $70,000 to $50,000 before finding a bottom in September, followed by a subsequent run toward $110,000 when President Trump won the election in November and took office in January 2025.

EVERY TIME JAPAN HIKES RATES, BITCOIN DUMPS 20–25%

NEXT WEEK, THEY WILL HIKE RATES TO 75 BPS AGAIN.

IF THE PATTERN HOLDS, $BTC WILL DUMP BELOW $70,000 ON DECEMBER 19.

POSITION ACCORDINGLY. https://t.co/VZfD5TzZvl pic.twitter.com/fSF0lpJ1fn

— 0xNobler (@CryptoNobler) December 13, 2025

A deeper examination of Japan’s impact on the crypto market indicates that the Yen carry trade plays a significant role. For decades, the Yen has been the top currency used by traders to borrow and convert into other currencies and assets, which arbitrages the low cost of borrowing Yen.

The carry trade is diminishing now as Japanese bond yields are rising rapidly and the BOJ is signaling it will raise interest rates by another 25 bps on December 19. This affects both traditional finance (TradFi) and crypto markets, as trillions of dollars are allocated to risk assets and bonds through this carry trade.

If Japanese rates rise too high, more of this borrowed money will need to be repaid as the arbitrage shrinks. The borrowers will be required to sell assets to repay the debt, and once they begin, a massive snowball effect will set in.

Bitcoin is highly liquid and macro-sensitive, making it a prime target for a Yen carry-trade unwind. You only have to look at the last 3 times the BOJ hiked rates to see. In March 2024, the BOJ hiked interest rates, and Bitcoin fell by -23%. Again in July 2024, Bitcoin dropped -27%, and the last time Japan raised its interest rates, in January 2025, Bitcoin tanked -32%.

DISCOVER: The 12+ Hottest Crypto Presales to Buy Right Now

Upcoming US Economic Data Points Dominate Crypto News Today

Several key US economic data points between December 15 and 19, 2025, position Bitcoin at a crucial point. Analysts are divided between fears of a significant correction and hopes that the Federal Reserve’s policy might mitigate potential impacts.

Upcoming BOJ data also adds to the mix, with Bitcoin bracing for a turbulent week as markets assign a 98% chance that the Bank of Japan will raise rates to 75 basis points on December 19. This move often triggers 20-30% drops.

The November Nonfarm Payrolls report is the first comprehensive snapshot of US labor conditions since September. It is also a key input into how markets price the Fed’s policy path into 2026.

Consensus forecasts indicate a sharp slowdown in job creation, with just 50,000 jobs expected, down from October’s 119,000, while the unemployment rate is projected to rise to 4.5% from 4.4%.

3 key US economic data points coming this week will heavily influence bitcoin sentiment. inflation and jobs numbers are always market movers, so expect some volatility. worth watching how these print.

— cryptobombast1c (@cryptobombast1c) December 15, 2025

Weekly Initial Jobless Claims is also another US economic data point to watch this week. This data point will provide a more immediate assessment of labor market stress. It shows the number of US citizens who filed for unemployment insurance for the first time the previous week.

Claims for the week ending December 13 are expected to come in at 223,000, down from the prior week’s 236,000, which itself marked a sharp jump from 192,000.

Perhaps the most crucial US economic data this week is the Consumer Price Index (CPI). The delayed November CPI report, postponed by a 46-day US government shutdown, is arguably the most consequential release of the week.

Headline inflation is expected to rise slightly to 3.1% year-over-year (YoY) from 3.0%, while core CPI is projected to remain steady at 3.0%. While inflation remains well above the Fed’s 2% target, any signs of cooling could solidify expectations for rate cuts as early as March.

In conclusion, Bitcoin and the broader crypto market are in a period of low fundamental activity as broader global macroeconomic conditions play out, primarily in the US and Japan. Crypto news today is relatively slow, with updates expected throughout the week as the market reacts to conflicting monetary policy updates from the US and Japan.

AVAX USDT Battles To Hold $12: Will SEC-Avalanche Crypto Friendship Save AVAX Price?

It is hard to believe that less than four years ago, AVAX USDT was trading in the triple digits, at an all-time high of $158. Since that day in early 2022, Avalanche crypto has fallen by -91%, with today’s -4.2% drop the latest bloodbath for the Layer-1 blockchain project.

During its height, AVAX was also a top 15 token by market cap, but has since dropped to 32nd, with a valuation of $5.3Bn, a fall from grace as the token was once valued at over $30Bn. A recent alliance with the US SEC has the Avalanche crypto community hoping that favourable oversight could rescue their token from the depths of hell.

Read the full story here.

Silver Futures Price Rally Is “Gold on Steroids,” But Have We Topped?

The Silver futures price has torn through every major resistance level this year, delivering one of its strongest annual performances in more than a decade. And it sucks, because the only time silver got a headline that I saw is when they called it the “Devil’s metal”. Meanwhile, every ATH for Bitcoin was blasted across every outlet.

It’s why we have permanent anti-silver shills on Twitter. But that stops now! (and who knows, maybe we’ll get more popular silver-backed cryptos)

Silver has now surged more than 120% year to date, outpacing gold, copper, and virtually every cryptocurrency besides Zcash and other privacy coins. However, despite the vertical rally, 99Bitcoins strategists say the move isn’t over yet.

Read the full story here.

Civil War Breaks Out on Aave Crypto: CoW Swap Fees Change AAVE Price Outlook

How’re my Aave Crypto ghosties doing? I was thinking of selling my AAVE (been holding since like $50) and using the proceeds to max out on Bitcoin and Zcash.

Does AAVE still have any legs? Well, I’ll answer it for you: maybe not as we head into 2026.

Aave, one of DeFi’s largest and most mature lending ecosystems, is now locked in a public fight over who controls the protocol’s revenue streams. What began as a routine integration with CoW Swap has spiraled into a broader debate about decentralization, ownership, and whether Aave Labs is siphoning off fees that belong to tokenholders.

Read the full story here.

Willy Woo Says Satoshi Poses No Threat: Is Bitcoin Hyper L2 The Smart Money Play for 2026?

As Bitcoin (BTC) continues to mature into a global macro asset, hyper-recurring fears that quantum computers could crack early wallets, including Satoshi’s Bitcoin holdings, resurface. This week, on-chain analyst Willy Woo dismissed those concerns, arguing that even a worst-case scenario would not threaten Bitcoin’s survival.

Against that backdrop, investors are increasingly looking beyond native Bitcoin alone and asking whether scalable Bitcoin Layer-2s like Bitcoin Hyper could be the more brilliant asymmetric play heading into 2026.

Read the full story here.

The post Crypto Market News Today (December 15): Bitcoin Loses $90K Heading into Yearly Close, Is It Officially Over? appeared first on 99Bitcoins.