UK payroll software reports PAYE information automatically after each payroll, keeps track of changing labour laws, manages employee pension deductions, distributes end-of-year P60s and P45s, and is HMRC-compliant. But, the best payroll software layers on functionality, such as automation, employee self-service, and advanced payroll cadences like managing Construction Industry Scheme (CIS) returns.

I’ve researched seven top UK payroll solutions and ranked them from best to worst according to an objective scoring rubric.

Top payroll software for UK businesses comparison

Plans and pricing are up to date as of 17/02/2025.

* Pricing excludes VAT.

** Starting price is for Xero Grow, the cheapest plan that includes payroll.

Sage Payroll: Best overall

My rating: 4.25 out of 5

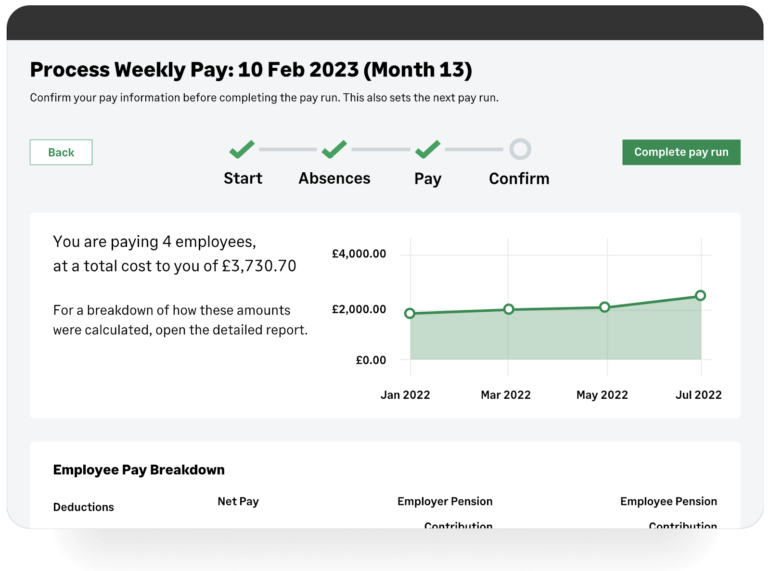

Sage Payroll is Sage’s starter payroll platform suitable for small and medium-sized businesses (SMBs). You have access to critical payroll features, including automatic Real Time Information (RTI) submissions to the HMRC for each payroll plus pension enrolments. Sage Payroll also includes basic HR features in every plan, like document, leave, and absence management, preventing you from integrating with a third-party human resources information system (HRIS) for this functionality.

You can also combine Sage Payroll with other Sage products for additional HR and accounting capabilities. This allows you to manage people and finances in one centralised system for more streamlined processes.

Pricing

With a score of 4.13 out of 5 for pricing, Sage Payroll rates one of the highest in my roundup due to its transparent pricing, 30-day free trial, and cheapest starting price. It does get more expensive as you progress through its product tiers and gain access to HR features like org charts and scheduling. But if you’re concerned with affordability, I’d look to BrightPay instead for immediate cost savings.

Plans:*

- Payroll Essentials: £10/mo. + 20% VAT

- Payroll Standard: £20/mo. + 20% VAT

- Payroll Premium: £30/mo. + 20% VAT

* All plans include up to 5 employees. For six employees and more, you’ll need to pay an additional £2, £4, and £6 per month on the Essentials, Standard, or Premium plans, respectively.

Note: Sage Payroll is currently running a three-month free promotion for new customers. Check out its website for the latest.

Key features

- Access to HR and payroll support

- Employee self-service

- Basic scheduling capabilities in the Premium plan

- Custom automations for approvals in Standard plan and up

Sage Payroll pros and cons

| Pros | Cons |

|---|---|

|

|

Why I chose Sage Payroll

Sage Payroll is a great stepping-stone for new businesses that must balance compliant payroll processes with basic HR features to maintain a small workforce. It is the only platform in my lineup to offer both in all its product tiers while maintaining a transparent pricing structure.

But one of the best reasons to go with Sage Payroll is its over 40 years of experience with UK companies and its enterprise-level selection of products to fit any business cadence. This means you can stay within the Sage family of products as your business evolves, reducing data migration headaches and new product learning curves.

For example, once you exceed Sage Payroll’s 150-employee cap, you can upgrade to Sage 50 and access advanced payroll capabilities, such as departmental views of the organisation. This more granular look at business costs allows you to adapt quickly to financial headwinds and even aid in strategic workforce planning.

Hire and pay people internationally? Check out the 5 Best Global Payroll Services.

BrightPay: Best for affordability

My rating: 4.03 out of 5 (if applicable)

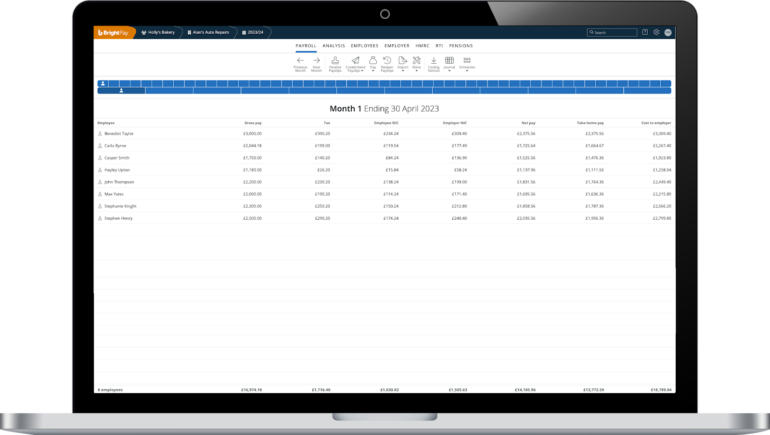

BrightPay is Bright’s payroll platform solution that recently released a cloud version of its desktop application. BrightPay is the only solution in my roundup to offer this, making it a more versatile option if you favour a more traditional software experience.

Because BrightPay’s cloud application is so new, it still reserves several capabilities for its desktop version, such as some statutory payroll reports, document uploads, and even CIS support. In the case of the latter, Bright allows you to use the desktop version free of charge to facilitate CIS returns, while the others remain on the product’s 2025 roadmap. Interestingly, access to features like employer and employee portals is still only available in BrightPay’s desktop version with the BrightPay Connect add-on that provides automated data backup to the cloud.

Pricing

BrightPay offers all of its features to its customers in each plan. Its price depends first on whether you want a desktop or cloud version and then on how many employees you have.

BrightPay desktop plans

- Up to 3 employees: £84/year + VAT

- Up to 10 employees: £149/year + VAT

- Up to 25 employees: £239/year + VAT

- Unlimited employees: £339/year + VAT

BrightPay cloud example costs*

- 3 employees: £8.25/mo. + VAT or £84/year + VAT

- 10 employees: £22.95/mo. + VAT or £235.20/year + VAT

- 25 employees: £40.95/mo. + VAT or £415.20/year + VAT

- 50 employees: £68.55/mo. + VAT or £691.20/year + VAT

- 100 employees: £103.55/mo. + VAT or £1,051.20/year + VAT

- 250+ employees: Call for a quote.

You can also add BrightPay Connect, BrightPay’s automated data cloud backup service, to the desktop version for an additional monthly fee. Plans are based on the number of employees you have, with some example costs below:

- 1 employee: £0.65/mo.

- 5 employees: £2.73/mo.

- 10 employees: £5.08/mo.

- 25 employees: £11.38/mo.

- 50 employees: £20.63/mo.

- 100 employees: £36.13/mo.

- 250 employees: £75.13/mo.

- 500 employees: £130.13/mo.

- 1000 employees: £210.13/mo.

* The price per month increases as your headcount increases. The prices listed are examples. You can also check out BrightPay’s cost calculator for more accurate estimates for your business.

Key features

- Ability to have multiple pay runs on the same pay frequency on the cloud version

- Customisable employee calendar

- Automatic pension re-enrolment alerts

- Unlimited attachment orders for every employee

- Per-employee expense and benefits tracking

BrightPay pros and cons

| Pros | Cons |

|---|---|

|

|

Why I chose BrightPay

BrightPay is the most affordable platform in my lineup, earning a whopping 4.56 out of 5 score for pricing. This is because BrightPay’s pricing is transparent, doesn’t require a long-term contract (for its cloud version), offers yearly discounts, and provides a 60-day free trial — one of the longest trial periods I’ve ever seen. This gives BrightPay a competitive edge since you have plenty of time to demo the product before committing.

BrightPay lacks the accounting features of Xero and QuickBooks and the sophisticated HR capabilities of ADP iHCM and Rippling. But if you only need payroll support, BrightPay supports all statutory payroll requirements at a fraction of the cost of competitors. For example, with 100 employees, you’ll pay only £103.55 per month for BrightPay compared to £200 per month for Sage Payroll Essentials — a savings of 48%.

Curious about other cheap payroll options? Learn more by exploring the links below.

Xero: Best for startups

My rating: 3.95 out of 5 (if applicable)

Xero is a small business accounting software that offers HMRC-compliant payroll in its higher subscription plans. Despite this, Xero’s accounting capabilities allow you to access more complicated payroll support, such as CIS returns, expense management, mileage, and project tracking.

Xero also integrates with hundreds of HR applications, including other payroll platforms like BrightPay, Onfolk, Personio, and Oyster, to easily fill any functionality gaps.

Pricing

Xero has four subscription tiers to choose from: Ignite, Grow, Comprehensive, and Ultimate. However, its cheapest tier, Ignite, does not include payroll, meaning the least you’ll pay to access payroll is £33 per month for its Grow plan.

Xero tied with Sage Payroll for pricing, earning a 4.13 out of 5. This is because Xero expands its accounting and payroll features with every subscription tier, while Sage Payroll focuses on levelling up its HR capabilities.

Plans:

- Grow: £33/mo. + VAT (up to 1 person)

- Comprehensive: £47/mo. + VAT (up to 5 people)

- Ultimate: £59/mo. + VAT (up to 10 people)*

* Each additional person after 10 is another £1 monthly for up to 200 people.

Note: Xero is currently running a six-month free promotion for new customers. Check out its website for the latest.

Key features

- Automatic pension assessments, reminders, and enrolments

- Xero Me employee self-service payroll app

- Predictive analytics with Analytics Plus in the Comprehensive plan and up

- Employee reimbursement management with receipt mobile capture

Xero pros and cons

| Pros | Cons |

|---|---|

|

|

Why I chose Xero

Xero is particularly well-suited for startups since it combines accounting, payroll, and employee experience features into one product. As you monitor your company’s profit and loss, Xero automatically facilitates pay-as-you-earn (PAYE) HMRC requirements and reconciles payroll costs with your general ledger.

Besides its project-tracking capabilities, such as its in-app time-tracker, Xero’s employee-specific Xero Me mobile application provides easy access for employees to view and manage payslips, leaves, and expenses. For startups with an often distributed workforce, this can be a major plus for employees not tied to a desk since they can complete important tasks without a desktop computer.

Learn more about Xero

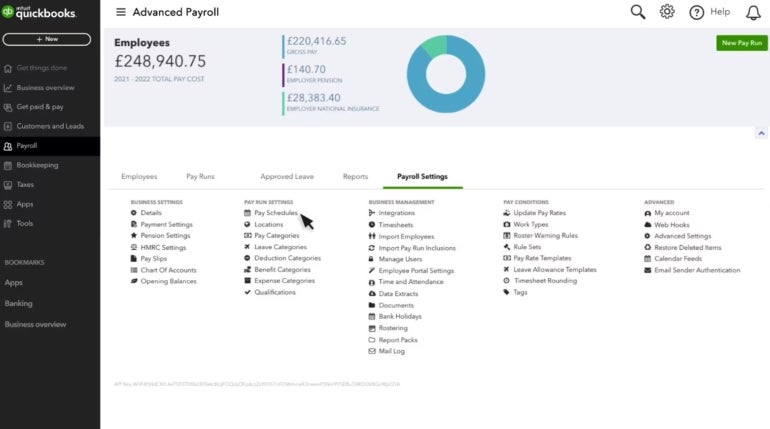

QuickBooks Payroll: Best for payroll and accounting

My rating: 3.92 out of 5 (if applicable)

QuickBooks Online is a well-known accounting solution that is part of Intuit’s small business product portfolio. Like Xero, QuickBooks Online supports payroll but only as an optional add-on with QuickBooks Payroll. QuickBooks Payroll is a good choice if you’re already using QuickBooks Online for accounting purposes but need to start paying employees.

QuickBooks Payroll offers additional HR features through QuickBooks Time, including time-off management, scheduling, and geolocation to prevent time fraud. Although an additional cost, this is a major plus if you pay a majority of your workforce at an hourly rate.

Pricing

QuickBooks Payroll has two plans, Core and Advanced. The Core plan calculates and distributes paychecks, remits RTI to the HMRC, supports weekly and monthly pay schedules, and calculates statutory parental and sick leaves. The Advanced plan includes everything in Core, plus timesheet management, automatic pay runs, and more payroll frequency options.

Intuit doesn’t reveal the starting price for its QuickBooks Payroll Core or Advanced plans. You also have to purchase QuickBooks Online first before choosing a payroll plan. QuickBooks Online plans start at £16 per month plus 20% VAT. You also have two discount options to choose from: 90% off the plan’s base price for six months or a one-month free trial.

Key features

- Automatic pension assessments and enrolment

- Statutory payment management

- Automatic pay runs for directors and salaried employees on the Advanced plan

- Rotas, timesheets, and expense management on the Advanced plan

QuickBooks Payroll pros and cons

| Pros | Cons |

|---|---|

|

|

Why I chose QuickBooks Payroll

QuickBooks Payroll’s connection with QuickBooks Online makes it a powerful tool for running all your small business financial needs in one place. Although functionally very similar to Xero, QuickBooks Payroll is the better option if you’re looking for more advanced controls, such as tracking stock and automatic payroll in its higher plans.

What’s more, QuickBooks Payroll offers more extensive HR features to help you manage your business’s money more effectively. Rota management, for example, comes standard in QuickBooks Payroll’s Advanced subscription for more precise employee scheduling that minimises Excel spreadsheet errors. You also have additional reporting options, such as splitting payroll costs by class and department, for more granular insights into labour costs and revenue streams.

Learn more about QuickBooks Payroll

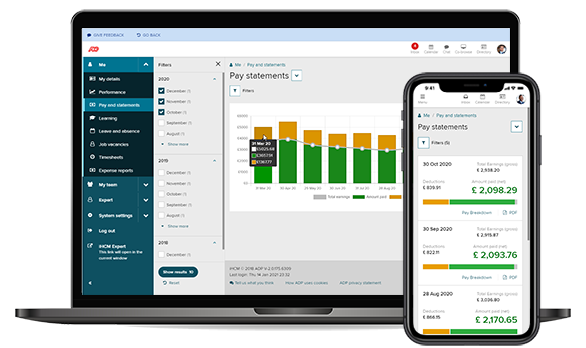

ADP iHCM: Best for workforce management

My rating: 3.86 out of 5 (if applicable)

ADP offers an array of payroll and HR products to fit a variety of business sizes and needs. Its iHCM product includes a healthy mix of critical HR tools that most standalone payroll solutions lack, such as recruiting, performance management, and learning administration.

Besides its HR features, another advantage of ADP iHCM is its scalability. The platform supports up to 1,000 employees, offers an open API to extend the platform’s functionality, and can even centralise payroll processing for more than 140 countries. This is a great option if your operations extend into mainland Europe, even if those global workers are contractors.

Pricing

ADP does not disclose its prices online; you must contact its sales team for a quote. But it does offer three different iHCM plans that I outlined below:

- Essential Edition: Basic payroll, personnel, timesheets, and document management.

- Standard Edition: Everything in Essential, plus leave and absence management, onboarding, expenses, and access to its AI tool.

- Advanced Edition: Everything in Standard, plus advanced analytics, performance management, recruitment, and learning administration.

ADP iHCM also offers a fair number of add-ons to choose from, including:

- ADP RealTime: Time and labour management

- ADP HR Everywhere: Employment legal advice

- ADP Payroll Disbursement Service: Money movement services

- ADP LocalPay: Managed payroll services for UK employees in Ireland or the Channel Islands

- ADP BackCheck: Online employment screening services

- APIs for application integration

However, due to ADP’s lack of pricing transparency, discounts, and free trial, it scored only a mere 1.63 out of 5 for pricing.

Key features

- Unified system for payroll and benefits administration

- Automatic P60s and P45s generation and filing

- Employee portals for managing self-service tasks, like accessing payslips

- Strategic business reports on payroll, recruitment, and staff demographics

ADP iHCM pros and cons

| Pros | Cons |

|---|---|

|

|

Why I chose ADP iHCM

ADP iHCM is the only platform in my top five with features that touch upon every stage of the employee life cycle. I was particularly impressed with its optional Talent Cloud module, which has features to support training, upskilling, and retaining staff. If you need a platform with more complex payroll schemes alongside features to manage your workforce and prepare your business for the future, ADP iHCM is my top choice.

However, I should note that ADP’s myriad of products, add-ons, and services can be quite confusing and overwhelming for small businesses with simple pay cadences. If that’s you, I’d consider BrightPay, which still allows for multiple pay frequencies.

That said, with a total score of 3.86, starting with ADP iHCM may be easier to stay with long-term if you expect your business needs to change rapidly — especially if you leverage its managed payroll services.

Learn more about ADP

Honourable mentions

The following platforms didn’t quite make my top five, but they still provided some great features that might better fit the needs of your organisation.

Staffology Payroll by IRIS: Best for small businesses

My rating: 3.72 out of 5

When to choose Staffology Payroll by IRIS: If you have fewer than 50 employees and don’t need anything but payroll support, Staffology Payroll is HMRC-compliant, uses a simple interface, and can be cheaper than Sage Payroll to start. Even better, you can bundle Staffology Payroll with Staffology HR to manage small business HR functions, like company handbooks, documents, org charts, employee engagement, and rotas.

Why it didn’t make the list: Running payroll in Staffology Payroll is still very manual, especially compared to systems like QuickBooks Payroll and Rippling. Staffology Payroll also requires you to integrate with either Staffology HR or a third-party HRIS for basic employee self-service, including viewing payslips.

Rippling: Best for reporting and analytics

When to choose Rippling: Rippling is an all-in-one HR platform with advanced IT, payroll, benefits, attendance, learning, recruitment, and performance management features. Its plans offer advanced reporting options, including customisable chart visualisations, allowing you to view payroll data alongside metrics like staff demographics for more in-depth insights.

Why it didn’t make the list: Rippling doesn’t reveal its starting prices, and its payroll functionality is an add-on module rather than included in every plan. Its sheer number of capabilities can also be too much for a small business where customising workflow automation and apps is less important than error-free payroll and managing business profit and loss.

UK business payroll software FAQs

What is the best software for payroll in the UK?

Sage Payroll is one of the best payroll software systems in the UK. Its low starting price of £10 a month to pay five employees makes it great for small businesses, and Sage’s more robust payroll products (Sage 50 and Sage People) support even bigger organisations with hundreds to thousands of employees.

Other top UK payroll providers include BrightPay, Xero, and ADP. Of course, the best UK payroll provider for you depends on what your budget can accommodate, what features you need, and how many employees you need to pay.

If you’re trying to choose a payroll provider, consider signing up for a free trial (if one is offered), viewing a demo, or requesting a product tour. First-hand experience can help you decide if a popular, well-reviewed payroll program is the best fit for you.

How much does payroll software cost in the UK?

Depending on the payroll software, you’ll either pay a flat monthly rate or a fee for each person paid. Sage Payroll, for example, uses both pricing schemes, costing £10 per month for the first five employees and then an additional £2 per employee per month for six or more employees. Generally, the more employees you need to pay, the more expensive the payroll platform.

But, if you’re new to payroll and want to minimise payroll costs, I recommend taking advantage of HMRC’s Basic PAYE Tools, which is free to businesses with fewer than 10 employees. Note that it is a desktop, not a cloud application.

Can I do my own payroll in the UK?

Yes, as a UK business owner and employer, you can do your own in-house payroll using payroll software. Make sure to choose only HMRC-approved payroll to ensure your business stays compliant with tax law.

Methodology

I picked my choices with you in mind.

First, I chose seven UK payroll solutions to run through an objective rubric based on current options and the reviews of customers like you. I then collaborated with a team of in-house research analysts led by Irene Casucian to collect information on each platform’s payroll features, services, user reviews, and technical capabilities. Below is a breakdown of the criteria I used to judge each platform:

- Payroll features: 30%

- Payroll services: 25%

- Platform and interface: 20%

- Pricing: 15%

- Support: 10%

As the market changes, I reevaluate my choices so you always receive the best insight for your purchasing decision.

Update Notes

Feb. 25, 2025: Jessica Dennis reviewed seven UK payroll solutions using a new scoring rubric. As a result, Rippling moved to an honourable mention while ADP iHCM and Staffology Payroll by IRIS replaced FreeAgent and Moneysoft. Jessica also rewrote most of the article, providing fresh analysis and expert insights.